Most mortgage brokers Sydney will recommend an offset account, let’s look a little closer at why.

If you have a personal mortgage, you want to save every cent you possibly can – don’t pay a cent more in interest than you need to! There are way better things to spend your money on I say.

An offset account could just be the very best place to stash your cash. We’re talking about a 100% offset account here – that’s the only one we recommend.

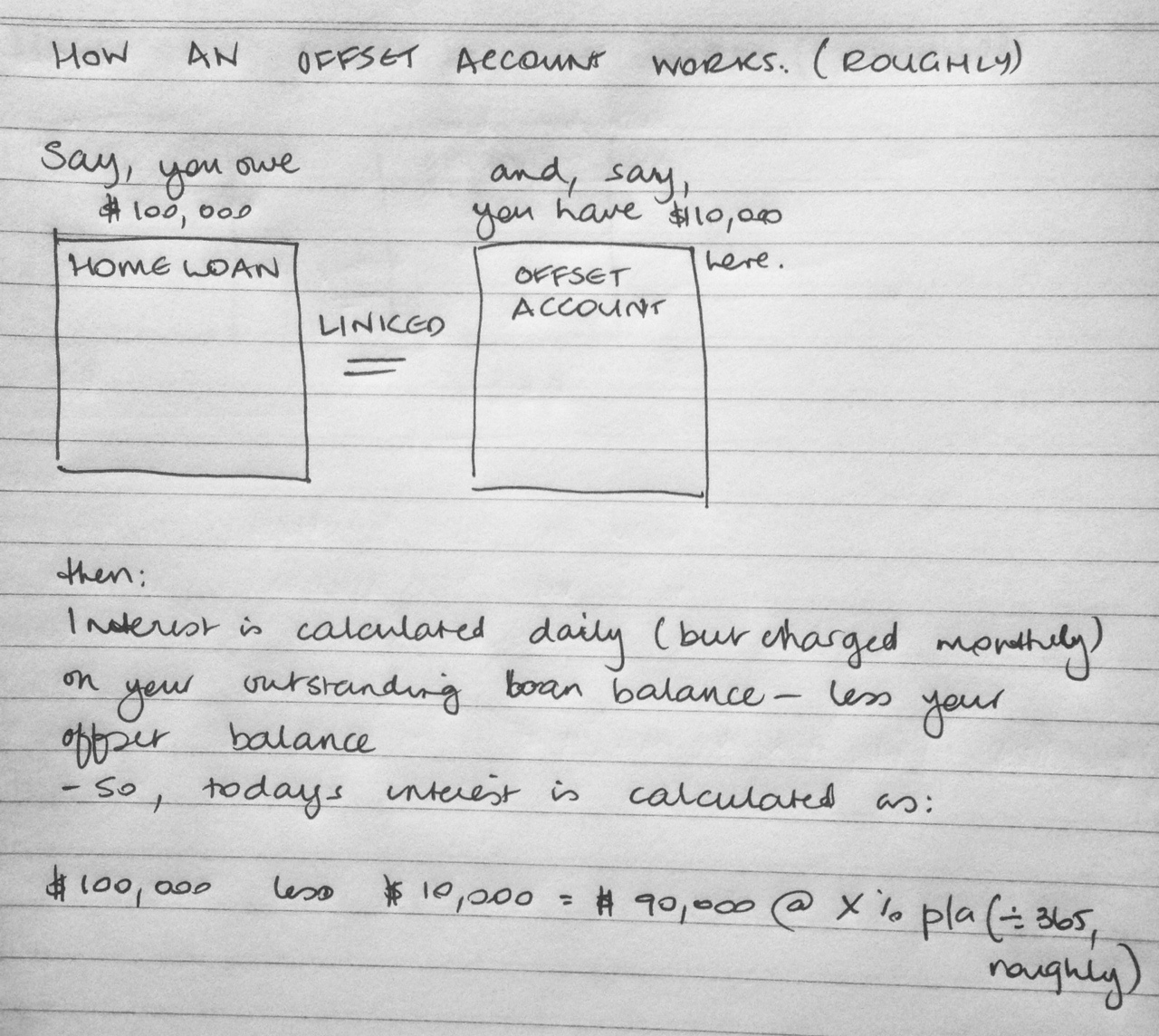

An offset account is a linked account – linked to your homeloan – and it effectively saves you interest as though the money has been repaid into the loan account itself.

Let me explain that, let’s say you owe $100,000 on your home loan and you have $10,000 sitting in your offset account your lender will calculate the interest due on the difference (interest is calculated daily and charged at the end of the month) and only charge you interest on the difference.

In this example, you will only be charged interest on the $90,000 difference. At an average interest rate today – lets say 5.5% p/a this is effectively saving you around $46 a month in interest, just by having the money sit in this linked account.

Additionally, the money is available to you via an ATM card and internet & phone banking which means it’s a perfect place for all of your spare money – rather than having the very good intention of moving over whatever is left at the end of the budget, but never actually getting there. The longer you leave the money in the account the better and every last dollar is working for you.

If this is your everyday account – which it often is, it means the money you have sitting in an account for milk and bread and everyday expenses is saving you interest – brilliant! Take this one step further and you could arrange for all of your bills to be debited off of a credit card with interest free days ( then arrange for the card to automatically pay off before the end of this time, and don’t be tempted to overspend) and automate your life. Your money is sitting in the account for longer so it’s saves more interest. You won’t miss a bill or get charged a late fee and you’re saving interest too! How good is that?! Did you know, some electricity suppliers in Sydney actually offer a discount for direct debit and paying on time. We’re racking up some serious savings now.

Of course, you could save interest in the same way by popping the cash into your home loan directly, but for most of us we either never get around to it, or we don’t want to leave ourselves short and so we just don’t. But offset, we do do that.

Comments are closed.