Most mortgage brokers will recommend an offset account, let’s look a little closer at why.

For investors, without a personal mortgage, an offset account could just be the very best place to stash your cash. We’re talking about a 100% offset account here – that’s the only one mortgage brokers Sydney would recommend.

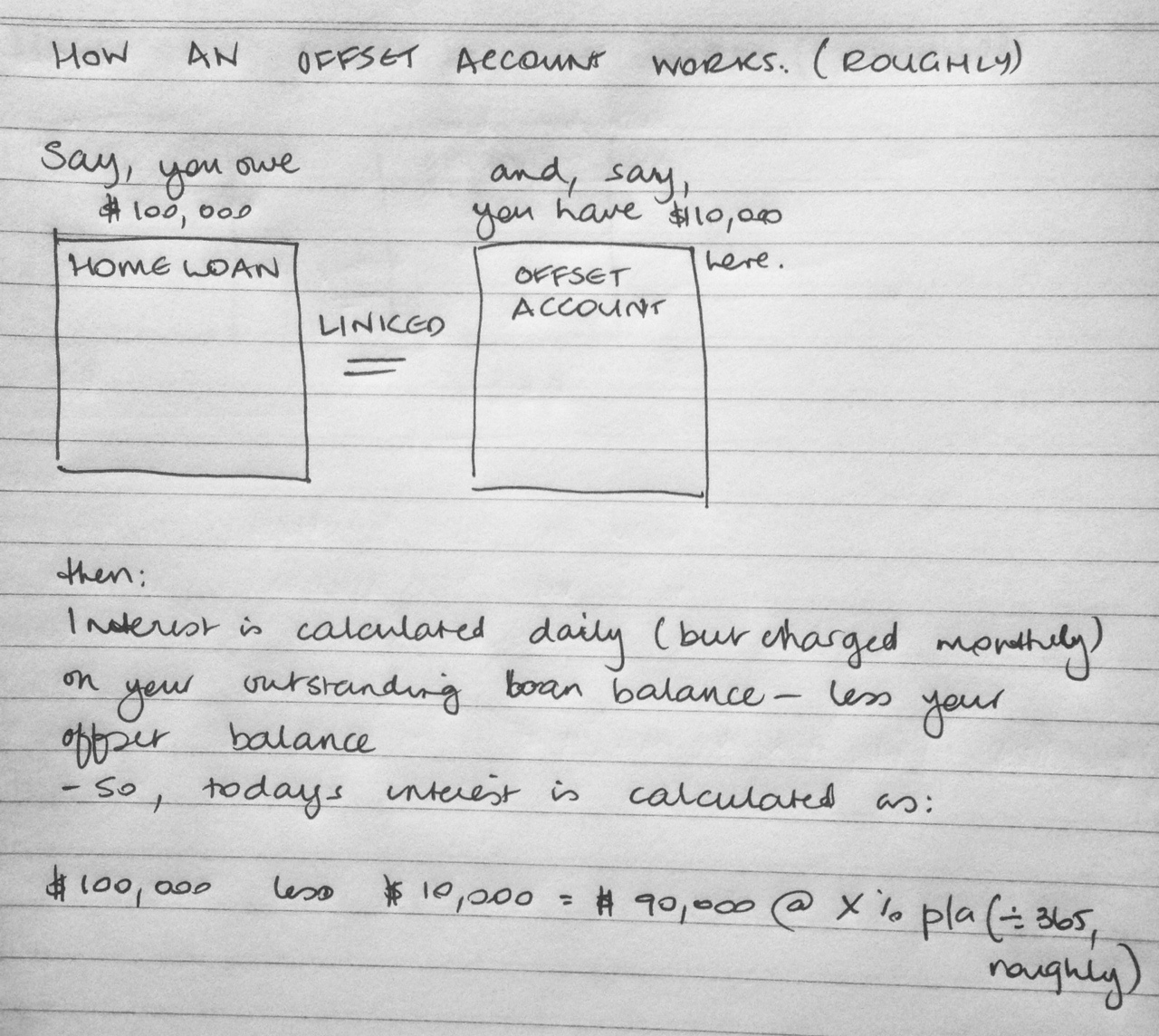

An offset account is a linked account – linked to your homeloan – and it effectively saves you interest as though the money has been repaid into the loan account itself.

Let me explain that, let’s say you owe $100,000 on your home loan and you have $10,000 sitting in your offset account your lender will calculate the interest due on the difference (interest is calculated daily and charged at the end of the month) and only charge you interest on the difference.

In this example, you will only be charged interest on the $90,000 difference. At an average interest rate today – lets say 5.5% p/a this is effectively saving you around $46 a month in interest, just by having the money sit in this linked account.

Additionally, the money is available to you via an ATM card and internet & phone banking which means it’s a perfect place for all of your spare money – rather than having the very good intention of moving over whatever is left at the end of the budget, but never actually getting there. The longer you leave the money in the account the better and every last dollar is working for you.

Of course, you could save interest in the same way by popping the cash into your home loan directly, but for investors this presents a problem if you need to take the money back out for purposes other than another investment. Your accountant will frown very heartily as each and every time you take money from your investment loan it is treated for it’s own purpose by the ATO. Trust me, you don’t need the headache when you can use the simple and effective, ever humble offset account.

Comments are closed.