OK, scandalous headline – sorry about that, but there’s some truth in it I’m afraid.

Credit cards are a brilliant tool if used effectively – I love them, I accumulate points like a madwoman with the aim of one day going somewhere fabulous. Tropical I think.

I use my card for everything possible then pay it off in full each month so I never pay credit card interest, brilliant!

The catch is to remember it is real money – I have seen people with a tendency to overspend because it doesn’t feel real – if you’re spending cash and your balance is dropping you will feel much more restrained than if you “just stick it on the card”, so be mindful of this. Its simply being mindful that you don’t overspend or impulse buy when you wouldn’t be happy to pay cash for the same item & clear your account out.

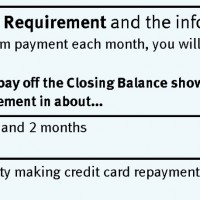

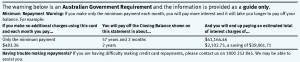

And always pay your card on time – preferably in full but if thats not possible you definitely must make at least the minimum repayment every month (while on the subject have you ever looked at how long it will take to pay off the card if you only make the minimum payment – I’ll post an example below of 57 years to pay off a $10,000 balance … let that sink in for a minute).

Where it used to be that it only hit your credit file if you were “in default” lenders now get a rating on how often you miss your repayments even if you’re only late by a few days.

Not paying your card on time; or not paying enough, can lead to a negative rating on your credit report under new legislation, and lenders are using this now as a criteria for approving your home loans.

They may not approve your loan at all or they may limit the percentage of the value of the home you can borrow – essentially requiring you to have more deposit and therefore limiting your purchase power. This could easily be the difference between a 4 bedroom home or 3, or a pool, or a different suburb altogether.

Finally, lenders look at all of your credit commitments when you’re borrowing, in essence they add all the repayments you have to make (and they assume you COULD go and use all of the credit – even if you don’t regularly do this) and essentially deduct this from whats available for you to use to pay off your shiny new home loan. This goes for interest free facilities too.

I’ve written extensively about how this works here – take a look, a $10,000 limit can equate to a reduction in your borrowing power of $80,000. What would that mean to you in terms of the home you can now buy?

And if you think you can just understate your limit or perhaps accidentally ‘forget’ a card or a loan – unfortunately this doesn’t work anymore. The new credit reporting regime which came into effect in March 2014 means credit files are now more accurate and informative, not only listing the late payments, completely missed payments, and the defaults but it now lists your actual liabilities and their true limits. This system change is slowly rolling out and we’re seeing the effect.

So, what to do:

- Definitely, pay your cards on time.

- Get rid of any unnecessary credit

- and use the credit that you have wisely – this has the pleasant side effect of removing impulse buying and actually leaving more cash money in your account for you to use on very important purchases, and / or increasing your own wealth.

Comments are closed.