We call it the three C’s of lending, the tests by which it is determined if you can borrow money, and if so – how much:

- Character

- Capacity

- Collateral

Let’s look at Capacity.

Online borrowing calculators will give you a very standard result as to what the bank might look at lending you – nothing beats a good broker with up to date knowledge on the 6000 odd policies that apply… I wish I was kidding!

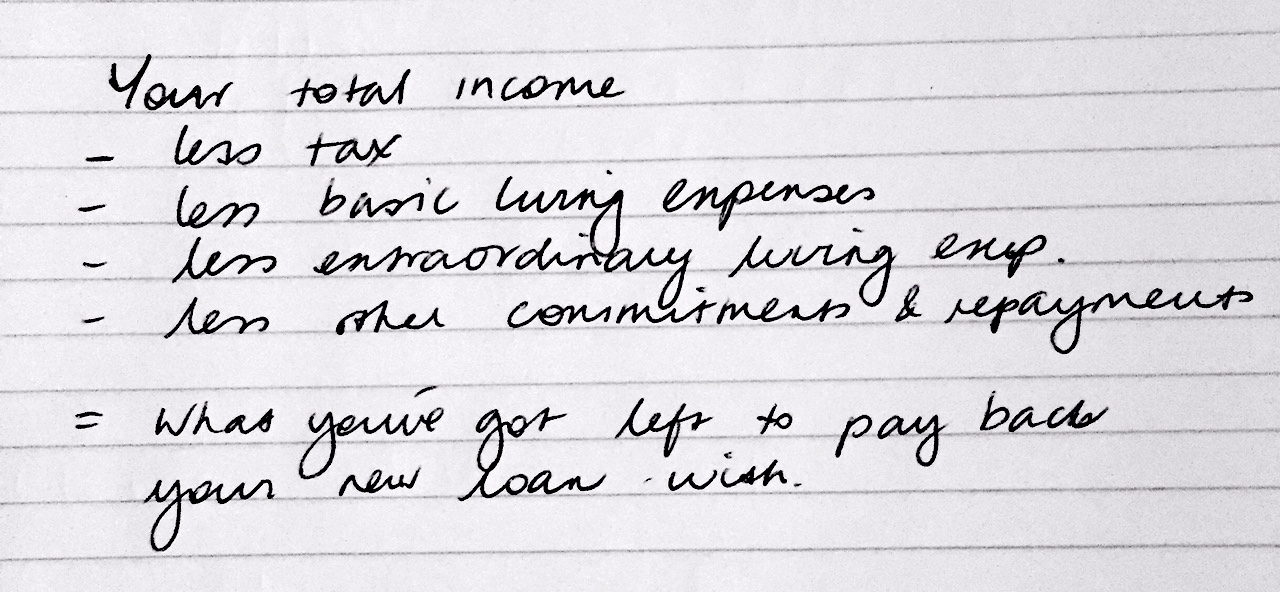

Basically, the banks look at the following:

- Your gross (before tax) income,

- less tax

- less living expenses for all under your roof – as determined by the lender

- less, extraordinary expenses, for example private school fees, HECS or HELP repayments

- less, any other commitments you have – other loans, credit cards, maintenance payments

- What you’ve got left over is potentially available for you to make your new repayments and they work this back to a loan amount.

Simple huh? I’m going to use a live example of a fairly average client to show you how different lenders are.

Income- this is pretty simple

Lets leave aside policies regarding self employed, overtime, commission, bonus income etc and assume the bank will use all of your available income after tax.

Basic living expenses

Most lenders work towards a scale of living expenses as determined by polls and research and reports based on the minimum average living costs in YOUR area, acknowledging that it probably costs more to run a car in the city than outer suburbs etc. You might have heard of the “HEM model”, or the “Henderson Poverty index”, these are some of the models the banks work towards. In our average example the living expenses for a family with two kids varies from $2702 per month to $3352 per month. Thats without changing postcode. $600 / month difference represents approximately $120,000 difference in loan amount.

Extraordinary expenses

Fairly self explanatory, with the exception of what the lenders consider “extraordinary” and what’s considered “basic”

Other repayments

The major difference here comes in with credit card limits –

Most lenders take 3% of your limit as your monthly repayment ($10,000 card, $300 / month)

Some take 2.5%, some take 2%

and there’s the odd lender who, if you prove you pay it all in full every month, will disregard the card completely.

Getting down to the actual loan!

Finally, we have our available cash for our new loan, and here again there’s a huge difference.

In all cases the banks test that you can afford the repayments now, and into the future – most use 4 years as a benchmark. There’s an assumption that rates will increase in the next 4 years, but how much? The “buffer” the lender adds to allow for these increases varies from 2% to 4% and a little over. It varies as much as the original rate before they add the buffer… I’m just saying! Scanning down my list I can see assessment (buffered interest rates) from 6.14% to 8.25%, quite a different.

Lenders do also consider if you might receive a tax break for the loan – for an investment property for example.

And the unfortunate thing that loan calculators can’t tell you is which lender has the perfect combination of the above for you!

What does it all equate to – well our average couple can borrow somewhere between $430,000 and $562,000 – which makes a significant difference when you’re buying a home. And this, the challenge of unwinding this, is part of the reason why I love my job!

PS – the loan amounts in this example won’t work for you, nor will necessarily MacBank lend YOU more than Bankwest – unless you’re incredibly average, and really who’s average these days! There’s no substitute for your fabulous mortgage broker.

PPS – if you walk in the door of the wrong bank, they can’t offer you the others and you just might walk out very unhappy.

Comments are closed.